Understanding the Pros, Cons, and Who It Might Help

With housing prices rising and affordability on everyone’s mind, you may have seen news about a potential new option: the 50-year mortgage. While uncommon in the U.S. today, this type of loan structure is being discussed as a way to help buyers—especially first-time homebuyers—manage high monthly payments.

So what exactly is a 50-year mortgage, and how does it work?

Here’s what you need to know.

What Is a 50-Year Mortgage?

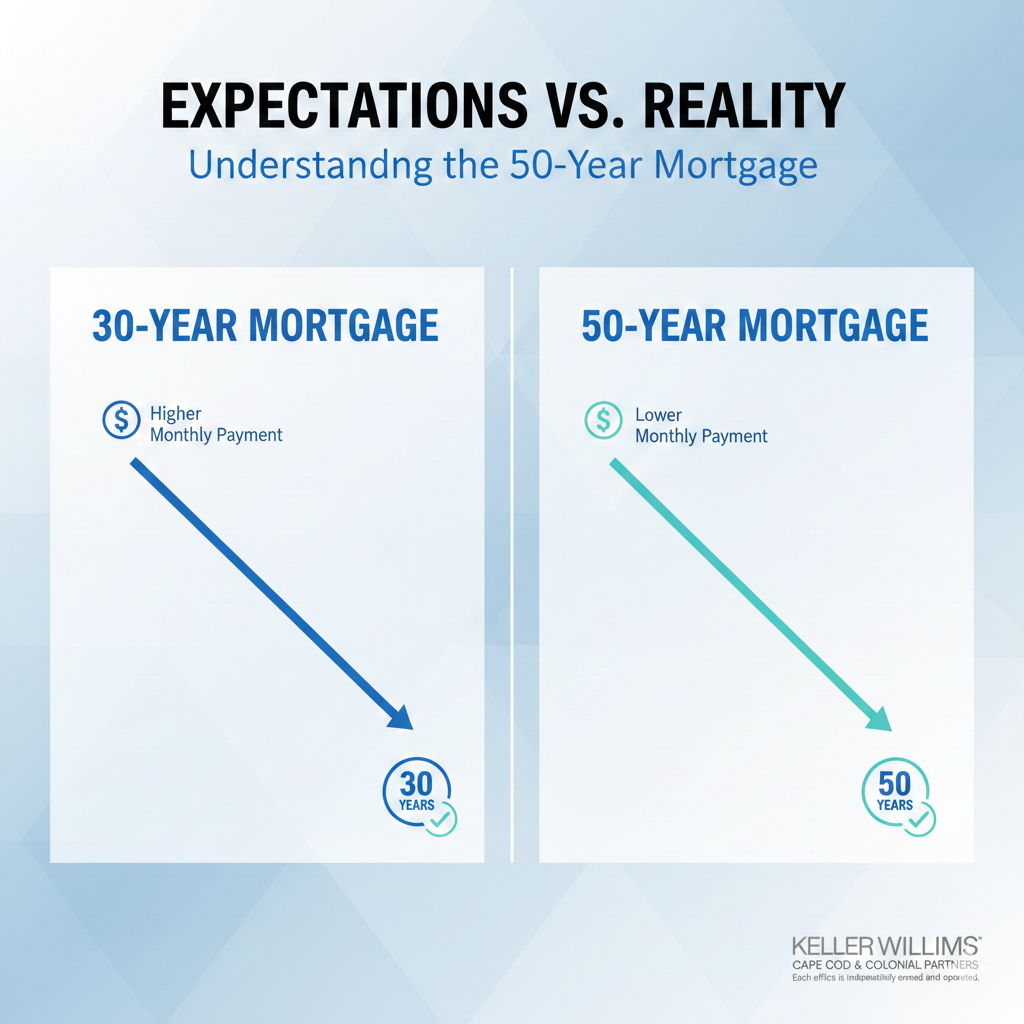

A 50-year mortgage is a home loan that stretches repayment over 50 years instead of the traditional 30 years.

The longer repayment term reduces the required monthly payment, which can make homeownership more accessible for buyers who are struggling to qualify for a home in today’s price and rate environment.

While this type of loan is not yet widely available in the U.S., it’s being discussed as a potential tool to help with affordability challenges—particularly in high-cost markets like Massachusetts and Cape Cod.

Why Would Anyone Choose a 50-Year Mortgage?

⭐ 1. Lower Monthly Payments

A longer loan term means smaller payments because you are spreading the cost over more years.

For many first-time homebuyers, this could be the difference between qualifying for a home—and not.

Benefit: Increased purchasing power and more manageable monthly expenses.

Trade-off: You pay more interest over the life of the loan.

⭐ 2. Improved Affordability in High-Cost Markets

In markets where starter homes can easily be $500,000+, even a 30-year mortgage may create monthly payments that feel out of reach. A 50-year term opens the door to neighborhoods and home types that might otherwise be inaccessible.

Benefit: Access to homes in better locations or with more space.

Trade-off: You’re committing to a very long financial horizon.

⭐ 3. Easier Loan Qualification

Lenders qualify you based on your debt-to-income ratio, and lower monthly payments make it easier to fit within required guidelines.

Benefit: More buyers may qualify or qualify for a slightly higher price point.

Trade-off: You must still show stable income and strong financial history.

So What’s the Downside?

While a 50-year mortgage sounds appealing, it’s important to understand the limitations.

⚠️ 1. You’ll Pay Much More in Total Interest

Stretching a loan from 30 years to 50 years dramatically increases the total interest paid over time.

⚠️ 2. Slower Equity Building

Because payments are so stretched out, your loan balance decreases very slowly.

This means it may take longer before you build meaningful equity in your home—especially in the early years.

⚠️ 3. Risk of Being “Upside Down” Longer

If home values dip, homeowners with ultra-long mortgages may owe more than the property is worth for a longer period.

Who Might Benefit Most From a 50-Year Mortgage?

A 50-year mortgage may make sense for:

First-time buyers struggling with high monthly payments

Buyers in high-cost markets like Cape Cod

Younger buyers expecting income growth over time

Buyers prioritizing payment affordability over long-term cost

It may not be a great fit for:

Buyers close to retirement

Buyers who plan to sell within a few years

Anyone who prioritizes rapid equity building and long-term interest savings

Final Thoughts: Is a 50-Year Mortgage a Good Idea?

The answer depends on your priorities.

A 50-year mortgage lowers monthly payments and improves affordability, which can help buyers enter the market sooner. But it also means more interest, slower equity, and a longer financial commitment.

If this loan type becomes widely available, the key will be understanding your long-term goals, your financial stability, and the trade-offs involved.

Homeownership should be a sustainable part of your financial future—not a burden.

If you’d like help evaluating what’s best for you, I’m here to guide you through your options with clarity and confidence.